Click HERE For

The Most Recent Exploring Finances Column

CF boosts local economy

By Lisa Stroub | College of Central Florida

Manager of Marketing and Public Relations

Published Jan. 29, 2026 at 10:30 a.m.

OCALA -- In just one year, the impact of increased earnings of College of Central Florida (CF) alumni and the regional businesses that employ them is equivalent to the economic boost of hosting the Super Bowl, according to a new report.

More Below This Ad

Click On Ad To Visit Website.

CF’s economic value to the Tri-County Area of Citrus, Levy and Marion counties in the 2023-2024 fiscal year is quantified in an independent report provided to the Association of Florida Colleges by Lightcast, a labor market analytics firm.

CF’s total annual impact was $507.7 million in added income.

CF’s total economic impact represents approximately 2.5 percent of the total gross regional product of the Tri-County Area, with one of every 37 jobs supported by the college and its students. The most significant impact comes from CF graduates employed in the regional workforce and the human capital they provide in the form of added knowledge, creativity, imagination and entrepreneurship.

The net impact of former CF students currently employed in the regional workforce amounted to $442.8 million in added income – comparable to hosting the Super Bowl.

“Thanks to the leadership of Gov. Ron DeSantis and Commissioner of Education Anastasios Kamoutsas, as well as support from the Florida Legislature, the College of Central Florida is able to invest in our local economy, “ Dr. Jim Henningsen, CF president, said. “CF is proud to provide high-quality education that’s valuable not just for our graduates, who benefit from higher lifetime earnings, and for local employers, who get access to a steady stream of qualified workers, but for all taxpayers across the communities we serve. Our students invest in their futures and the college provides an incredible return on investment for our area.”

Every Floridian benefits from the Florida College System, the studies determined, reporting that for every dollar invested in the FCS in 2023-2024, Floridians received $13.30 in return.

Publisher's Note: Another Tri-County Area of Florida is the Levy, Gilchrist Dixie counties part of the state. The Citrus-Levy-Marion region is viewed from the state's perspective for some colleges and for workforce data.

Auto insurance rate cuts approved

Information Provided

By Florida Office of Insurance Regulation

Published Jan. 28, 2026 at 7 p.m.

TALLAHASSEE -- Florida Insurance Commissioner Mike Yaworsky is approving additional auto insurance rate cuts for the new year. USAA filed an average 7 percent rate decrease that will take effect by May 2026—resulting in more than $125 million in estimated annual savings for USAA’s Florida members.

The Florida Office of Insurance Regulation continues to approve rate cuts for auto insurance. In the last year, 42 companies covering personal auto lines have filed for rate decreases -- with 32 of the companies filing within the last six months.

“Going into the new year, the Office of Insurance Regulation is not slowing down on approving rate decreases or 0 percent increases from insurance companies. USAA is just one of many auto insurance companies that OIR is having great conversations with to ensure reductions for policyholders,” Yaworsky said. “We are thrilled with the progress in the home and auto insurance market since the critical legislative reforms were passed. It is very clear that tort reform was the right thing to do, and we will continue to build on this success.”

A leader in USAA commented.

“Every dollar counts for our active-duty service members, veterans and their families – now more than ever,” USAA Property & Casualty President Randy Termeer said. “This rate decrease reflects improving conditions in Florida’s insurance market, as well as our ability to price competitively while maintaining the financial strength to take care of our members when they need us. Florida leaders have done great work to strengthen the insurance system and support a more stable, competitive market for Floridians.”

USAA is attributing this significant rate decrease to Florida’s strong legislative reforms that have stabilized that market.

Commissioner Yaworsky joined Gov. Ron Desantis earlier this month to announce rate relief for the auto and home insurance market. The announcement highlighted other significant recent rate decreases from auto insurance companies:

● Florida Farm Bureau: average decrease of -8.7 percent.

● Progressive: average rate decrease of -8 percent. This is in addition to their recent announcement to refund policyholders over $1 billion.

● State Farm: average decrease of -10.1 percent. This is State Farm’s third rate reduction since 2024, reducing more than 20 percent in total and amounting to over $1 billion in savings statewide.

● AAA: Three separate rate reductions over the year, lowering premiums by -15 percent. Last fall, AAA filed a fourth round of rate reductions for auto policies that will take effect early 2026.

● Allstate: 13,100 drivers average decrease of -4 percent.

Thanks to Florida’s tort reform, the auto insurance market is experiencing great stability and growth. In 2024, Florida ranked #1 as the state with the lowest personal auto liability loss ratio, recorded at 53.3 percent, the lowest recorded for Florida in the last 15 years.

Florida personal auto insurers experienced the nation’s fifth-lowest incurred loss ratio at 57.5 percent, a noteworthy decrease from 73.2 percent in 2023 and 89.7 percent in 2022. Auto physical damage loss ratios in Florida also made a remarkable shift, dropping from 112.0 percent in 2022 and 70.3 percent in 2023, to 66.7 percent in 2024.

Florida’s home insurance market also continues to see overall market stabilization. Since reforms, 17 additional insurance companies have entered the marketplace and OIR has received more than 185 residential filing requests for rate decreases or 0 percent increases. Since January 2024, 39 companies have filed for a rate decrease and 48 companies have requested no change or 0 percent increase.

The 30-day average request for homeowners’ rates is -2.3 percent, compared to +0.5 percent one year ago. The 180-day average request for homeowners’ rates is -0.7 percent, compared to +7.9 percent one year ago.

Why Social Security

Matters More For Women

Published Jan. 26, 2026 at 10 a.m.

NEWBERRY -- When planning for retirement, Social Security isn't just another item on your financial checklist.

For women especially, it's often the cornerstone of a secure retirement. The Social Security Administration reports that nearly 55 percent of Social Security benefit recipients are women, and for many, it's their primary source of retirement income.

Unlike investments that can lose value when the market drops, Social Security provides guaranteed income that adjusts for inflation and generally lasts as long as you live. That reliability makes it valuable for helping to address two major retirement risks: rising costs and the possibility of outliving your savings.

Life expectancy. On average, women live about five years longer than men (CDC 2023 Life Expectancy measure. That means they rely on Social Security for a longer period, making the decision of when to start benefits especially important.

Taking Social Security early reduces your monthly benefit. You can claim benefits as early as age 62, but every year you wait increases your monthly payments by two-thirds of 1 percent, or 8 percent per year, maxing out at age 70. Given women's longer life expectancy, that patience can pay off.

Building your benefit. Your Social Security benefit depends on your 35 highest-earning years. If you have years with zero or very low earnings in that calculation, it can reduce what you receive in retirement. Many women step away from work or reduce their hours to care for family members, and that trend is increasing. A 2025 University of Kansas analysis found that the share of mothers with children under age 5 leaving the workforce fell more in early 2025 than at any point in the past 40 years. The study also noted that rising return-to-office policies may continue to impact working mothers.

While staying in the workforce builds a stronger earnings history and better benefits, that isn’t realistic for everyone. Those who can’t, may need to plan and fund alternative sources for retirement income.

Protection for married women. Marriage can provide additional Social Security options. A lower-earning spouse may receive up to 50 percent of their partner’s full retirement-age benefit.

If your spouse dies, you can receive the higher of your own benefit or up to 100 percent of your deceased spouse’s benefit. However, if you remarry before age 60 (age 50 for disabled widows), you lose eligibility for survivor benefits from your late spouse while the new marriage lasts.

Women divorced after at least 10 years of marriage may qualify for benefits based on an ex-spouse’s record. If you remarry, you forfeit spousal benefits while the new marriage continues.

A word of wisdom: Report any name changes following marriage or divorce to the Social Security Administration to ensure your earnings and benefits are correctly credited.

Navigate carefully. Given the complexity of Social Security rules, the unique retirement challenges women face and the lasting impact of claiming decisions, working with a qualified financial advisor can be invaluable. An advisor can help you navigate questions about timing, spousal benefits and how Social Security fits into your overall retirement plan.

Publisher’s Note: This article was written by Edward Jones for use by Edward Jones Financial Advisor Sheila K. Smith and Edward Jones Financial Advisor Ashlyn W. Burtle. New Location -- 1845 S.W. 249th Drive, in CountryWay Town Square, Newberry. Phone 352-472-2776.

Edward Jones moves to

new office in Newberry

Edward Jones Financial Advisor Sheila Smith is seen in her office, which is one of three, where Financial Planner Ashlyn Burtle also has an office and there is one vacant office.

Story and Photos By Jeff M. Hardison © Jan. 23, 2026 at 7:45 p.m.

All Copyrights Protected By Federal Civil Law

Do Not Copy and Paste to Social Media or Elsewhere

NEWBERRY – While Financial Advisor Sheila K. Smith and Financial Advisor Ashlyn W. Burtle enjoyed their office in downtown Newberry, the new office in CountryWay Town Square is even better. Five years in the making, the relocation to 1845 S.W. 249th Drive, Newberry, was worth the wait Financial Planner Smith said in an interview shortly before the grand opening celebration on Friday evening (Jan. 23).

“We love it,” Smith said. “The natural light makes it bright and conducive to good thinking.”

Clearly the structure is relatively new, and it has that new building look inside and out.

The exterior of the Edward Jones building in Newberry is clearly visible on the corner.

The Welcome mat is at the front door for visitors to know they have found the right place for financial advice.

The front lobby is open and has seating for people waiting to be seen.

This table built by Chris Smith is the centerpiece in the conference room, offering a pleasant and professional place for speaking with one another.

Tortillas Tex Mex Restaurant, next door to Edward Jones, offers a menu that shows an extensive variety of delicious choices.

Smith said they designed the multi-office structure from an empty shell internally.

“It’s gorgeous,” she said. “We made it look elegant and special.”

Chris Smith, Sheila’s husband, built that beautiful table in the conference room. Ashlyn and her husband Will Burtle framed the lobby and conference room. These final touches are part of what makes this setting so special for them, their staff members and for the clients who visit.

The grand opening included an arch of balloons, as well as other balloons and celebratory decorations. Guests enjoyed a tour of the three offices, the lobby, the conference room and other areas of the facility. Visitors also enjoyed a mixture of treats from Tortillas Tex Mex Restaurant next door.

CountryWay Town Square in Newberry is a mixed-use community featuring residential structures, the StoneHouse Neighborhood Grill, BIM Fitness Center, as well as the Tex-Mex restaurant and a butcher shop.

Guests at the new Edward Jones Newberry office enjoyed the firepit that is in the common area as part of the celebration that lasted past sundown.

Among the first advantages visitors will notice when they visit the new building move is reserved parking spaces for Edward Jones customers, which is better than the street parking in downtown Newberry.

To make an appointment for financial advice with Smith or Burtle, call 352-472-2776. Branch Office Administrator Alicia M. Davis or Branch Office Administrator Laurel A. Barber will help arrange those appointments.

FDACS announces $6.3 million

for forests and waters

Application deadline is March 27

Information Provided

By Florida Department of Agriculture and Consumer Services

Published Jan. 22, 2026 at 4 p.m.

TALLAHASSEE – Yesterday (Wednesday, Jan. 21), Florida Commissioner of Agriculture Wilton Simpson and the Florida Forest Service announced a total of $6.3 million is available to Florida landowners through two cost-share programs.

Florida’s Future Forests Program and the Enhancing Gulf Waters Through Forested Watershed Restoration (RESTORE) Program aim to improve forest health and water quality by promoting tree planting and timber stand improvement practices that help ensure the long-term viability of Florida’s forestlands. Applications for both programs will be accepted until March 27.

“Florida’s forests are some of our most valuable natural assets – protecting water quality, supporting wildlife, and fueling an industry that supports thousands of jobs,” Commissioner Wilton Simpson said. “These programs are a significant long-term investment for the state and will help maintain and preserve Florida’s forests and natural resources for future generations.”

Florida’s Future Forests Program is open to non-industrial, private landowners, local governments, and registered nonprofit organizations. Interested applicants should contact their Florida Forest Service County Forester to initiate the application process. Applicants may request funding for tree establishment practices on a minimum of 10 acres and up to 250 acres. To learn more, visit https://www.fdacs.gov/FutureForests. The deadline for application submission is 3 p.m. Eastern Standard Time on March 27.

“Private lands make up the majority of Florida’s forestlands, and these funds will help landowners reestablish forests, improving water quality and enhancing overall forest health,” Florida Forest Service Director Rick Dolan said.

Since 2021, the Florida Legislature has appropriated approximately $18 million for this program. These funds have already been used to create over 50,000 acres of healthy forests in Florida.

An additional $2.3 million is available through the RESTORE Landowner Incentive Program. These funds are available to non-industrial private landowners, local governments, and registered nonprofit organizations located within specific priority watersheds. This program includes reforestation, prescribed burning, first pulpwood thinning, mechanical underbrush treatment, and chemical underbrush treatment, for practices on a minimum of 10 acres up to 250 acres. For more information, visit FDACS.gov/Restore. The application deadline is 3 p.m. EST on March 27, 2026.

The Florida Forest Service, a division of the Florida Department of Agriculture and Consumer Services, manages more than 1.2 million acres of state forests and provides forest management assistance to more than 17 million acres of private and community forests. The Florida Forest Service is also responsible for protecting homes, forestland, and natural resources from the devastating effects of wildfire on more than 26 million acres.

FGC gets $5 million for nursing education

Information Provided By FGC

Published Jan. 22, 2026 at 3:30 p.m.

LAKE CITY – Florida Gateway College (FGC), through a partnership with the Lake Shore Hospital Authority (LSHA), has been awarded the Florida LINE Grant in the amount of $2.5 million.

With an additional $2.5 million from LSHA, a combined $5 million will be used to establish the LSHA Promise Program, supporting FGC nursing programs and students.

The Florida LINE (Linking Industry to Nursing Education) Grant is an initiative designed to strengthen the state’s nursing workforce by funding nursing education programs in collaboration with healthcare providers by matching funds from industry partners. Combining FGC’s expertise in nursing education with the LSHA’s commitment to community health, the Promise Program will support FGC nursing students and improve the health and wellbeing of their communities.

The initial $2.5 million in LINE Grant funds will be immediately put toward scholarships, instructional equipment, and resources that directly impact FGC nursing students. With the additional $2.5 million from LSHA, the Foundation for Florida Gateway College will establish a scholarship endowment for Columbia County students pursuing an Associate of Science Degree in Nursing (ASDN) from FGC. The endowment is expected to be sustained for a minimum of 25 years with hopes to be permanently endowed, supporting eligible students and local healthcare resources for generations to come.

Cyber security and other bills

paid in Gilchrist County

By Jeff M. Hardison © Jan. 17, 2026 at 10 a.m.

All Copyrights Protected By Federal Civil Law

Do Not Copy and Paste to Social Media or Elsewhere

TRENTON – The four members of the Gilchrist County Board of County Commissioners present for the Jan. 15 meeting took care of business in the usual manner that late afternoon and evening.

They agreed 4-0 to pay $28,620 for a bill from OTM Cyber for security, and the details of that are further down in this story.

This month, the special meeting was the only one for that set of five elected leaders. Normally, Chairman Darrell Smith, Vice Chairman Bill Martin, and commissioners Sharon A. Langford, Tommy Langford and Kenrick Thomas meet on the first and third Monday of the month.

As 2026 started, Commissioner Thomas was ill and did not attend the only meeting in January. Everyone knows that for him to miss a meeting, he was extremely ill.

As far as the business aspect of the County Commission meeting in mid-January, through one 4-0 vote, commissioners approved the consent agenda, which included:

● Approval of the Dec. 15, 2025 County Commission minutes;

● Approval of payment to Gray Construction Services Inc. for an invoice amount of $188,457.80, which is part of a grant-funded $1.6 million contract to build the new UF/IFAS Gilchrist Extension facility;

● Approval of payment to North Florida Professional Services invoice for $13,745.25, which is part of a grant-funded contract for $413,795 worth of work at the Gilchrist County Emergency Operations Center, north of Bell; and

● Approval of funding not to exceed $1,700 for the travel request from Gilchrist Animal Services to attend the Annual Florida Animal Protection and Advocacy Association’s Training Conference to attain required credit for educational units. This expenditure is in the annual budget.

Gilchrist County Administrator Bobby Crosby, Gilchrist County Sheriff Bobby Schultz and Gilchrist County Finance Director Richard Romans, as well as Gilchrist County Attorney Duke Lang helped the four commissioners understand the $28,620 for a bill from OTM CYBER Cyber Security Services.

Through the combined input of those four gentlemen, the four commissioners learned the due date for payment of the bill was Nov. 16, 2025.

The proverbial bottom line in this matter is that the Gilchrist County received a $100,000 grant to cover cybersecurity issues in the county. Through the approved process, the GCSO contracted with OTM CYBER Cyber Security Services to conduct certain actions.

That cost of $28,620 is covered through the $100,000 grant, and there was a need for the budgeted funds specified for that purpose to be designated to pay that bill in regard to that security for the county’s 9-1-1 system.

County commissioners also voted 4-o to purchase another portable flashing message board at a cost of $18,858.70. Now the county has two rather than one.

Added Employee

Among the many other 4-0 votes of approval from the County Commission, they agreed to authorize the hiring of an additional employee in the Solid Waste Department.

County Administrator Crosby and the County Commission congratulated Gilchrist County Solid Waste Department Director Bobby Rush on continuing to run a safe and efficient solid waste transfer program.

As Crosby spoke about this matter, he provided extensive information to support a request from Rush for one additional full-time solid waste staff member.

Due to increases in volume, service locations and operational demands, it has become increasingly difficult to maintain adequate staffing levels for daily operations, as well as coverage for vacations and sick leave, Crosby explained.

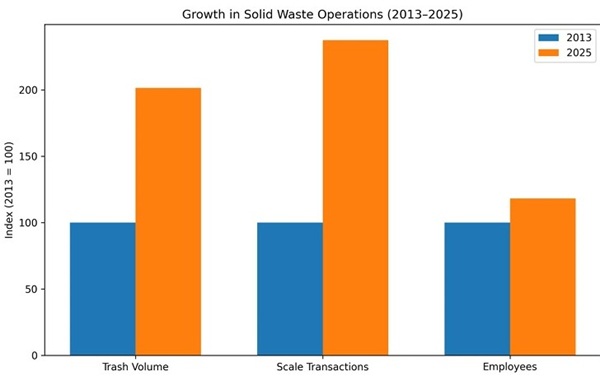

An operational growth overview comparing 2013 with 2025 shows:

Operational Growth Overview

2013

● 11 employees operating the Main Center in Bell and 2 outlying locations;

● Trash transport to New River provided by Alachua County;

● 2,922 tons of trash processed (approximately 146 semi-loads); and

● 4,426 scale transactions, generating $114,540 in revenue.

2025

● 3 employees operating the Main Center in Bell and 5 outlying locations;

● Trash transport to New River provided by the county;

● 5,886 tons of trash processed (approximately 294 semi-loads), representing a 101 percent increase; and

● 10,509 scale transactions, a 137.44 percent increase over 2013, generating $334,060 in revenue, a 191.65 percent increase over 2013.

Crosby also showed how the people of Gilchrist County pay a significantly lower per-capita fee as a special assessment for solid waste transfer services in contrast with both Levy County and Dixie County:

● Gilchrist County’s Solid Waste operations cost approximately $68.18 per resident;

● Levy County: $239.37 per resident; and

● Dixie County: $231.48 per resident.

The graph below shows the growth in volume of garbage between 2013 and 2025 as well as lack of staffing growth of the department in Gilchrist County during those 12 years.

Verizon customer service tied up

Publisher succeeds

after two-hour investment

By Jeff M. Hardison © Jan. 16, 2026 at 3:15 p.m.

LEVY COUNTY – A nationwide snafu Wednesday (Jan. 14) by Verizon plagued that company’s customer service representatives well into Friday afternoon (Jan. 16).

The company sent an email to Verizon customers, including HardisonInk.com publisher Jeff M. Hardison, promising a $20-per-account refund.

“I have three telephone lines and one modem,” Hardison said. “I could not get the My Verizon to accept me as the person that I am. All of those lines are on one account.”

The multiple award-winning journalist said patience is required to achieve results with mega-corporations.

Hardison went to the retail outlet in Chiefland that sells Verizon products.

“‘Vanessa’ couldn’t resolve the refund issue,” Hardison said. “She intimated that some person had registered me as the ‘manager’ of my telephone services rather than as the ‘owner.’”

A customer service agent at the actual Verizon corporate office fixed that listing.

Rather than contacting federal law enforcement to assist with unraveling the problems, Hardison spent 45 minutes listening to “on hold” music until a human being helped disconnect and then reconnect all services for the daily news website owner.

“In all,” Hardison said, “I spent more than two hours to fix problems I had with Verizon. I expect that should resolve these issues. Yes, there are thousands of people who lost a bit of my service because I had to redirect my resources to overcome this snafu and to accept my $20 refund. Oh well. At least I know Verizon should work better for me now.”

The publisher said he has not found a way around using Verizon for certain services, yet; however, Fiber By Central Florida has helped him reduce the cost of Internet service as well as allowing him to end TV service from Direct TV, and the expense of streaming TV is lower than cable TV for him.

“If I could carry Voice Over Internet Protocol (VOIP) on the three cell phone lines, then I would transfer that to Fiber By Central Florida,” he said. “VOIP is only available where the fiber service exists at The Ink Pad. I would still keep the portable MiFi from Verizon, because I will use it when I evacuate or when I go out of the area to cover news, etc.”

Verizon continues to have problems

By Jeff M. Hardison © Jan. 15, 2026 at 8:15 p.m.

LEVY COUNTY – Verizon admitted having a nationwide failure, the company sent a press release to allege it was due to a problem in New Jersey.

It sent an email to Verizon customers, including HardisonInk.com publisher Jeff M. Hardison.

“It was the perfect storm,” Hardison said. “I had gone to Sarasota County on Monday, Tuesday and Wednesday (Jan. 11-14) and I brought my Verizon MiFi portable modem to continue serving readers.”

Hardison said he had a portable computer with a hard drive and all of the connections needed, just as he has done during many evacuations. That method had worked perfectly each time before.

“I choose against using public networks for uploads and downloads,” he said, “because I reduce odds of danger to my daily news website by doing so.”

Except for a top story about a suspected murderer from Williston, the publisher did not put much on the website Monday and Tuesday until he returned to Levy County Wednesday afternoon, where he used Fiber By Central Florida -- and he was back in business.

“I laugh at Verizon,” he said. “They sent me a link to claim my refund, and it does not work. There is no way to confirm that my username and password are correct, either. It sends a message that the system is not working.”

He said that when his wife said there was zero ability to use her phone on Wednesday, he decided to take it to the retail outlet in Chiefland on Thursday. Then it started working.

“I guess I’ll spend time tomorrow (Friday, Jan. 16) to try and accept this alleged refund,” Hardison said. “I probably will revise some of the services I pay for now.”

Publisher renews memberships

with Dixie County Chamber

and Withlacoochee Gulf Area Chamber

By Jeff M. Hardison © Jan. 9, 2026 at 10 a.m.

JEMLANDS – Jeff M. Hardison, the sole proprietor and publisher who is doing business as HardisonInk.com, announced Friday morning (Jan. 9) that he had renewed his membership with the Dixie County Chamber of Commerce and the Withlacoochee Gulf Chamber of Commerce.

Both chambers had sent him email reminders to renew membership, he said.

On Thursday afternoon (Jan. 8), he renewed his membership in person during the Dixie County Chamber of Commerce meeting in Cross City.

He had sent a letter via the United States Postal Service earlier in the month to renew with the Withlacoochee Gulf Area Chamber of Commerce.

The Tri-County Area businessman said there are many chambers of commerce in the area. During the past 20 years that he and his wife, and various pet cats, have resided in Levy County, on different years, he has belonged to the Bronson, Cedar Key, Chiefland, Dixie County, Fanning Springs, Gilchrist County, Williston and Withlacoochee Gulf Area (once known as the Inglis-Yankeetown Chamber of Commerce) chambers. The Bronson Chamber of Commerce had a short-lived return to action years ago, but it dissolved since then.

Fanning Springs was absorbed by Gilchrist County, but some years ago it reappeared to some degree.

“I saw the most positive result over the most recent years from the Dixie County Chamber of Commerce, and more recently the Withlacoochee Gulf Area Chamber of Commerce has impressed me as a member.” Hardison said. “I have had some fun as a member of the Cedar Key Chamber of Commerce, the Fanning Springs Chamber of Commerce, the Chiefland Chamber of Commerce, the Gilchrist County Chamber of Commerce and the Williston Chamber of Commerce in past years. I contacted Cedar Key, Chiefland, Gilchrist County and Williston chambers about restarting my membership there but, I did not hear a response yet from any of them.

“It makes me laugh, though, when I see any Chamber that does not send press releases to non-member media outlets,” he added. “Although few people know this, I have served as a public relations agent for a worthwhile organization before. I would send information to all 15 sets of TV, radio, and weekly and daily newspaper contacts in that market back then. If a Chamber is supposed to promote business in a community, it seems ill-advised to not send information for free publication in the strongest media market in the area.”

The journalist added that he provides a $500 annual ad at the bottom of the Community Page to Chambers and a couple of the other organizations to which he belongs as a member.

The businessman said there may be other chambers that are interested in communicating with the daily news website owner. He welcomes press releases from interests that can benefit the residents and visitors of Levy County, Gilchrist County and Dixie County, including law enforcement agencies that use social media platforms to post “press releases.”

“I was a member of the Citrus County Chamber of Commerce for a year some years ago,” he said. “That is the only chamber where I had a negative experience. The Gilchrist County Tax Collector's Office sent me a notice that I had to pay an occupational tax in that county if I was going to do business there. So, I quit being a member of that Chamber very quickly, even though I still buy products and services in that county, as well as in other Florida counties when I travel for business or leisure.”

Levy County employees honored

Pausing for a photo opportunity after the presentation of Milestone Service Award certificates are (from left) County Commissioner Johnny Hiers, Layce Hallman, County Commissioner Rock Meeks, Christopher Castleberry, Clayton Drew, Willie Strawn, Commission Chairman Tim Hodge, Michael Miller, Human Resources Director Jacqueline Martin, Commissioner Charlie Kennedy and Commissioner Desiree Mills. (Not pictured are Lonnie Terry, Jimmie Jones, and Charlie Townsend.)

Story and Photo By Jeff M. Hardison © Jan. 7, 2026 at 7:30 p.m.

All Copyrights Protected By Federal Civil Law

Do Not Copy and Paste to Social Media or Elsewhere

BRONSON – Employees in different departments of the Levy County Board of County Commissioners were recognized for their years of service at a ceremony on Tuesday (June 6).

Held in the auditorium of the Levy County Government Complex, Milestone Service Award certificates were presented for completion of these employees’ first five continuous years of service and at the end of every additional five years of service for the quarter ending Dec. 31.

Levy County Human Resources Department Director Jacqueline Martin gave the certificates to the recipients.

Lonnie Terry of the Landfill Department has served for 20 years now, Martin said. He was busy at the job and could not attend on Tuesday.

Layce Hallman has been in the Library Services Department for five years.

From the Levy County Department of Public Safety (also known as Levy County Fire Rescue), Jimmie Jones has served 25 years; Clayton Drew has served 20 years; and Christopher Castleberry has served 10 years.

From the Road and Bridge Department, Michael Miller has 25 years of service; Charles Townsend has 20 years of service; and Willie Strawn has 5 years of service.

Human Resources Director Martin also noted there were plaques available to be presented for retirees.

All of them had begun their retirement, but those retirees are Jessie Durrance of the Levy County Road and Bridge Department, with more than 41 years of service; Robert Allen, also of the Levy County Road and Bridge Department, with more than 27 years of service; and Shelia LeMatty, with the Levy County Maintenance Department, with more than 15 years of service.

$167.5 million in awards granted

to improve infrastructure

in 34 Florida rural communities

Cedar Key, Cross City, Gilchrist County

and Levy County are among recipients

Information Provided By Governor’s Press Office

Published Jan. 7, 2026 at 4:15 p.m.

STEINHATCHEE – Today (Wednesday, Jan. 7), Gov. Ron DeSantis announced an additional $167.5 million in awards to improve infrastructure in 34 small and rural communities across the state.

These awards come from funding through the Community Development Block Grant-Disaster Recovery (CDBG-DR) Infrastructure Repair Program, helping areas impacted by the 2023 and 2024 Storms—Hurricanes Idalia, Debby, Helene, Milton and the 2024 North Florida Tornadoes and funding from the Rural Infrastructure Fund (RIF).

“Today, I announced funding for critical infrastructure projects in 34 small and rural Florida communities,” said DeSantis said. “These awards, totaling $167.5 million, will bolster long-term recovery efforts in areas hit by major storms in 2023 and 2024 – and these investments will also help ensure that our rural communities remain competitive, resilient, and full of opportunity for Florida families.”

The Florida secretary of commerce was at the event this morning, too.

“As the #1 state in the nation for attracting and developing a talented workforce and higher education and proven by the more than 70,000 private sector jobs created in 2025, Florida is delivering the resources needed to help job creators and job seekers succeed and storm-impacted rural communities rebuild smarter and stronger,” said Florida Secretary of Commerce J. Alex Kelly. “For many of the communities hit hardest by the 2023 and 2024 Storms, these projects are far more than just infrastructure repairs—they are an investment into the foundation of daily life. By restoring damaged stormwater systems, repairing overwhelmed wastewater treatment facilities and reinforcing services Floridians rely on every day, we are helping rural communities return to normal operations while also strengthening their long-term economic resiliency.”

With nearly 590,000 new businesses created in 2025 alone—more than any other state—Florida has seen a record of more than 4 million business formed since 2019. In November 2025, total private employment increased by 70,100 jobs (+0.8 percent) over the year—jobs which support those newly created businesses.

These significant numbers underscore how Florida’s continued investment in workforce development, talent attraction and critical infrastructure in combination with strong fiscal discipline has helped to better position Florida to withstand national economic headwinds—ensuring job creators and job seekers find opportunities for success and communities hit hardest by a disaster are able to rebuild and economically rebound.

Strategic investments in workforce development and critical infrastructure, as well as Florida’s pro-business policies have earned the state the #1 ranked economy in the nation by CNBC for three consecutive years and by U.S. News & World Report for two consecutive years. Florida has also earned a reputation of attracting and developing a talented workforce—earning the #1 ranking in that category by Lightcast and ranking #1 in higher education for ten consecutive years. Since COVID, Florida has held the line, continuing to expand our workforce—now with a record 11.2 million labor force—and kept the state unemployment rate (4.2 percent) under the national average (4.6 percent) for 61 consecutive months.

Taylor County will receive nearly $36 million in awards through the Community Development Block Grant Program and the Rural Infrastructure Fund:

● City of Perry

$12,000,000 – to construct a new parallel treatment train, which will enhance operational resilience and safety during future storms.

$8,500,000 – to replace current wastewater infrastructure and install modern equipment—managing capacity, ensuring regulatory compliance and enhancing system resilience during future storms.

$4,500,000 – to create a resilient independent water source by restoring capacity and increasing the reliability of Well No. 3 that will directly serve the City of Perry if the main treatment plant or water lines are compromised during a hurricane.

● Taylor County Board of County Commissioners

$1,050,000 – to repair and reconstruct residential roads in Steinhatchee to reduce recurrent flooding and prevent future washouts.

$4,969,425 – to construct the Taylor County Special Needs Emergency Shelter.

$298,440 – to determine the best available location in Steinhatchee for the construction of critically needed infrastructure for a commercial seafood off-load, processing and distribution facility through the Rural Infrastructure Fund.

Doctor’s Memorial Hospital in Taylor County ($4,431,981) – to install a whole-facility emergency power system, replace hospital phone and communications systems and modernize the facility’s water treatment system through the Community Development Block Grant-Disaster Recovery (CDBG-DR) Mitigation Program

Additional Community Development Block Grant Funds have been awarded to:

● Jackson County Board of County Commissioners ($3,260,000) – to add a new well, pumping equipment and water storage system needed to provide emergency services to Jackson County.

The following communities will receive funds through the 2023 and 2024 Storms Community Development Block Grant-Disaster Recovery (CDBG-DR) Infrastructure Repair Program:

● Big Bend Water Authority ($4,514,185) – to repair and replace critical water mains in Steinhatchee and Jena.

● Cedar Key Water and Sewer District

$7,349,280 – to construct and harden the Cedar Key Water and Sewer District potable water system.

$4,124,017 – to harden the Cedar Key Water and Sewer District Wastewater Treatment Facility.

● City of Carrabelle ($2,569,775) – to repair damages and harden Carrabelle’s Sanitary Sewer Collection and Treatment Systems.

● City of Gretna ($7,156,377) – to rehabilitate and upgrade the city’s production wells, the foundation of the municipal water supply system.

● City of Monticello ($14,158,044) – to rehabilitate or replace deteriorated lift stations and force mains, install permanent standby generators at critical sites, elevate and harden electrical and mechanical components and integrate systems monitoring to improve storm response.

● City of Port St. Joe ($25,000,000) – to rebuild and strengthen the wastewater treatment facility by upgrading current infrastructure.

● Gilchrist County Board of County Commissioners ($1,298,634) – to install updated drainage systems that are underperforming or have been damaged in previous storms.

● Hamilton County Board of County Commissioners ($1,200,000) – to restore and provide needed improvements to Hamilton County’s sole sheltering facility.

● Lafayette County Board of County Commissioners ($1,382,403) – to restore and harden the drainage and roadway system that serves residents, school buses, agriculture and emergency vehicles.

● Levy County Board of County Commissioners

$1,107,015 – to eliminate a severe safety hazard, restore essential recreational and tourism access, and increase resiliency for this vulnerable coastal location.

$358,000 – to complete a Fire Emergency Response and Control Project—ensuring reliable emergency services in one of the county’s most vulnerable and hazard-prone regions.

● Liberty County Board of County Commissioners ($1,500,000) – to improve, repair and resurface the Bristol Boat Ramp to ensure safe access, mitigate environmental damage and enhance long-term resiliency.

● Madison County Board of County Commissioners ($8,000,000) – to construct the Madison County Special Needs Shelter at the Madison County Emergency Operations Shelter.

● Town of Cross City

$32,062,208 – to build a new wastewater treatment plant and repair the sewer lines in the city.

$5,708,267 – to improve and upgrade stormwater drainage by installing elliptical reinforced concrete piping along the streets, further collecting stormwater into the main drainage ditch alongside U.S. Highway 19.

● Wakulla County Board of County Commissioners ($2,822,481) – to design and construct a project to line manholes, gravity sewer and tie-ins in the Panacea Shores Units residential subdivision's central wastewater system.

The RIF program supports infrastructure projects that drive job creation, capital investment and strengthen economies in Rural Areas of Opportunity (RAO), rural counties and rural communities. For Fiscal Year (FY) 2025-2026, the Florida Legislature appropriated $17 million for the RIF statewide program and $5 million for the Panhandle-Specific program for a total of $22 million. FloridaCommerce received a record 112 applications requesting more than $195 million in funding during the 2025-2026 RIF application period. Since 2019, the program has awarded more than $110 million in grant funds.

The following communities will receive funds through the Rural Infrastructure Fund Program:

● City of Blountstown ($200,000) – to implement improvements aimed at reducing stormwater and groundwater inflow and infiltration into the municipal wastewater collection system.

● City of Gretna ($700,000) – to build a new roadway extension that will serve as an access route to a greenfield site designated for commercial development.

● City of Marianna ($1,441,500) – for infrastructure improvements at Marianna Airport to support retention, expansion and investment of Maintenance, Repair and Overhaul (MRO) companies at the airport.

● Franklin County ($176,100) – to create the first Master Site Plan for the Apalachicola Airport, supporting business development for aerospace and aviation companies requiring hangar space and runways to conduct operations.

● Hamilton County ($300,000) – to construct a new building at the Alapaha Commerce Center—providing flexible, move-in-ready facilities designed to attract logistics, distribution and advanced manufacturing companies.

● Madison County Board of County Commissioners ($105,000) – to create a master plan for the Madison County Industrial Park, to include planning, market research and utility assessments necessary to guide Madison County Development Council's outreach to prospective companies.

● Town of Jennings ($300,000) – to complete the planning, design and permitting of a new production well as well as critical improvements and upgrades to the existing water treatment plant.

● Town of Ponce de Leon ($1,500,000) – for critical upgrades to Lift Station #3 and the replacement of the force main serving the Interstate 10 and State Road 81 interchange—ensuring reliable utility service, strengthening infrastructure resiliency and enabling long-term economic development in the community.

● Washington County Board of County Commissioners ($3,500,000) – to stabilize and improve Holmes Valley Road, providing critical access to the Old Shores Resort and Golf Club—generating approximately 90 new jobs.

DeSantis previously awarded $311 million in awards to improve infrastructure in 37 Florida communities. These awards follow the previous announcement and invest in critical infrastructure needs ranging from utility and transportation improvements to emergency operations resources in these communities—especially supporting critical water infrastructure investments across the state.

State shows FDOH and FDEP

details on septic tank regulators

Septic tank installation

and repairs projected to increase

By Jeff M. Hardison © Jan. 7, 2026 at 9:15 a.m.

All Copyrights Protected By Federal Civil Law

Do Not Copy and Paste to Social Media or Elsewhere

TALLAHASSEE – Both the Florida Department of Environmental Protection (FDEP) and the Florida Department of Health (FDOH) as of Jan. 6 provide service to the public as the regulatory agencies for septic tanks, according to information from those two parts of state government.

A year after the initiation of the state government’s plan to have the FDEP be the agency for the entire state with full compliance expected to be by June 1, 2030, the FDEP still only rules over 16 counties.

Property owners in the Tri-County Area of Levy County, Gilchrist County and Dixie County, as noted in an answer from the FDEP in a Jan. 6 email to a question posed by a journalist Dec. 23, 2025, are still regulated for septic matters by the FDOH.

In the Tri-County Area, the FDOH is one unit, known as the Tri-County Unit of the FDOH, where most Florida counties have individual FDOH offices. All FDOH offices are under one agency, though.

The email was sent by the FDEP to the journalist at the wrong email address, which only works occasionally, even though the question clearly showed the updated email address of the 15-year-old daily news website.

“Each time a state agency’s worker sends me an email to ‘editor@hardisonink.com’ rather than the specified correct email of ‘hardisonink@gmail.com,” daily news website publisher Jeff M. Hardison said on Jan. 7, “I know that person has not seen the updated email I have repeatedly noted.”

The publisher noted that sometimes the old email works even though he changed servers several years ago when his friend who wrote the original computer code for the website passed away from cancer and the journalist had to switch servers.

In any event, answers were found.

The FDEP currently regulates septic tank issues in 16 of Florida’s 67 counties. Those counties are Bay, Calhoun, Escambia, Franklin, Gadsden, Gulf, Holmes, Jackson, Jefferson, Leon, Liberty, Okaloosa, Santa Rosa, Wakulla, Walton and Washington, according to information provided Jan. 6 by FDEP Deputy Press Secretary Nikki Clifton.

A developer of a recreational vehicle and travel trailer park in Levy County, relatively near to Cedar Key, recently received an extension on a special exception to Levy County building and zoning regulations, as noted in the Dec. 24, 2025 story titled RV park to be completed by Dec. 31, 2027; Roads approved, which can be seen by clicking HERE.

During that public hearing before the Levy County Board of County Commissioners last month, one commissioner told the woman and people in the audience that the County Commission does not regulate septic tanks. While he was correct in that statement, when he went further into his version of what the developer must do, he misspoke about state regulatory agencies.

Public records show the following:

The FDEP has taken over the regulation of septic tanks, also known as onsite sewage treatment and disposal systems (OSTDS), in certain counties. This change is part of a broader effort to protect Florida's water resources and includes the following key points:

● Transfer of Permits: The FDEP is responsible for implementing the Florida Statutes and regulations applicable to OSTDS, effective July 1, 2021.

● New Regulations: Starting January of 2025, the FDEP will take over septic system permitting from the Department of Health in 16 counties. (As noted, a year later that is the progress that remains stagnant as of Jan. 6, 2026.)

● Financial Assistance: Some counties, like Leon County, offer rebates up to $7,500 for compliant installations.

These changes reflect the state government’s focus on the environment and its aim to improve water quality by minimizing nutrient pollution from septic systems.

The state government recommends that homeowners and property owners stay informed about their local requirements and the new regulations to ensure compliance and protect Florida’s water resources.

The proverbial bottom line for people in the Tri-County Area is that cost from septic tanks and their septic drain field, also known as a leach field or absorption field, are anticipated to increase significantly in the near future in regard to those facilities being installed or to repaired. Those price increases are anticipated as the FDEP moves forward with its Basin Management Action Plan (BMAP).

A BMAP is a framework for water quality restoration that contains a comprehensive set of solutions to achieve the pollutant reductions established by a TMDL.

A TMDL is the Total Maximum Daily Load. That is a scientific calculation of the maximum amount of a specific pollutant (like nutrients or bacteria) a waterbody can receive daily and still meet state water quality standards, serving as a pollution reduction target to restore impaired waters.

Examples of BMAP influences on development or repairs and other septic-oriented matters include permit limits on regulated facilities, urban and agricultural best management practices, wastewater and stormwater infrastructure, regional projects and conservation programs designed to achieve pollutant reductions established by a TMDL.

A BMAP is developed with local stakeholders and relies on local input and commitment for successful implementation.

BMAPs are adopted by the state government and are legally enforceable. BMAPs use an adaptive management approach that allows for incremental load reductions through the implementation of projects and management strategies, while simultaneously monitoring and conducting studies to better understand the water quality and hydrologic dynamics.

Progress of a BMAP is tracked by assessing project implementation and water quality analyses. The FDEP continues to work with local and regional partners to identify additional projects necessary to meet reduction milestones to achieve the TMDLs and inform funding priorities, according to the FDEP.

County commissioners, including Levy County Commissioner Rock Meeks, have commented, even as recently as the Jan. 6 County Commission meeting, that the state government imposes mandates on county governments with no method for the counties to fund what is required for the attainment of those demands by the state leaders.